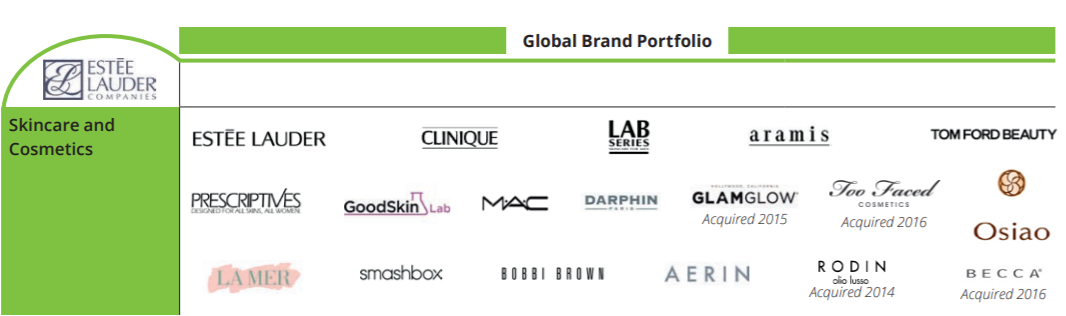

Nowadays, it is important for brands to have innovative and revolutionary products. However, these products will never become successful without an effective distribution plan. It is essential for companies to know how to distribute their products. What is a distribution channel ? Quite simply, it is the path that a good takes from the supplier to a consumer. Companies must know how to distribute their products correctly, for example, L’Oréal. L’Oréal owns a number of brands which are organised by Division. Each of these brands develop a specific vision of beauty by consumption universe and distribution channel. L’Oréal has different distribution plans for each of the brands. For example, La Roche Posay cannot be found in just any store as it comprises of medical products and so therefore is distributed to pharmacies.

There are four types of distribution channels for the marketing of cosmetic products to the general public ;

1. Large and medium-sized retailers

2. Selective distribution (ie. perfume shops or specialty stores)

3. Mail order and Internet sales

4. Pharmacies and parapharmacies.

In the past, pharmacies and parapharmacies have been the most successful distribution channel for cosmetic products, and cosmetic companies have largely focused their attention on these medical care providers. Increasing numbers of physicians have been prescribing skin care treatments and dispensing products to their patients, creating a favorable environment for beauty marketers within pharmacies. In order to keep distribution lines open within the medical sector, cosmetic companies have been very clued-in to the latest trends within pharmaceuticals. Tailoring their products to match with physicians’ recommendations has meant that their products will be prescribed and distributed through the medical sector. When people come to pharmacy, they seek medical advice and a guarantee of the product’s effectiveness relying on different brand names. Famous brands such as La Roche-Posay, Vichy, Avène or Bioderma are good examples. In the United states, ingredients such as Retinols, hyaluronic acid, and vitamins are very popular. Due to this trend, several large and medium-sized marketers have been introducing cosmetic products which are formulated with these ingredients. Such products include ; SkinCeuticals H.A. Intensifier by L’Oréal, Dermalogica Overnight Retinol Repair by Unilever, and PCA Skin’s Hyaluronic Acid Boosting Serum.

Due to heightened environmental concern, cosmetic companies have also adapted their products to be more eco-friendly. As more and more consumers have come to learn about the detrimental effects of airborne pollution, both on their skin and to the ozone layer, they have expressed greater interest in anti-pollution products and their sales have soared. Due to this new trend in anti-pollution marketers have introduced products, such as Pollution Shield Broad Spectrum SPF 46 Sunscreen by Santé and Alto Defense Serum by SkinBetter Science. We can see how cosmetic companies cleverly adapt their products to fit in with new pharmaceutical trends in order to ensure that the medical sector remains their largest distribution channel.

Although, the medical sector has been a stable and successful mode of distribution for cosmetic companies throughout the years, technological and digital innovations have largely altered the distribution process and therefore, must be taken into consideration. With the rise of 21st century individualism, consumers are becoming more focused on personalization. Technology has provided the perfect platform to enable consumers to do so. Cosmetic companies have realized that the 21st century consumer must be at the head of the production process and have invested vast sums in technological innovations which will enable this to happen. The 21st century consumer is autonomous, individual and in control. Cosmetics companies must give them the freedom to design, to innovate and take charge of their purchasing experience. The control, therefore, is shifting from the company to the consumer and the distribution method must reflect this change. Naturally, the internet has become a major distribution channel due to these changes however, new technology is not just limited to the internet but can be seen within stores too. This employment of new technology to complement the consumers’ new need for personalization is probably best seen in the case of Sephora. Sephora is the French leader in the perfume industry who has included a new feature called ‘Beauty Hub’ in their stores where customers can use new digital technology to try products and have a new connected terminal system that makes it easier for customers to order.

These technological innovations have even paved the way for new distribution channels to emerge, such as medical spas. As the professional skin care space continues to record strong growth, outlets dispensing skin care and offering professional treatments continue to evolve. SkinCeuticals is currently opening Advanced Clinical Spas, a new concept that the marketer began rolling out in 2016. Alchemy 43 and SkinLaundry, both new emerging players in the market, have also launched similar projects which fall within the medical spa realm. Since 2017 Skin Laundry has specialized in laser and light therapy with 13 locations in the United States. As of 2017, Alchemy 43, had just one location open but had plans to expand. The company concentrates on cosmetic micro treatments. Rising interest from consumers for custom-tailored beauty and fun store formats suggests that more specialty professional doors will surface in the coming years.

References :

Sai Swaroop (March 22, 2018) : “Top five trends to watch in the U.S Professional skin care market”, retrieved from

Etudes et Analyses : “La distribution des produits cosmétiques”, retrieved from

Cecile Desclos (Mai, 2018) : “Les stratégies digitales des marques et des enseignes de beauté”, retrieved from

Click to access LEE_beauté_et_digital_HD2.pdf

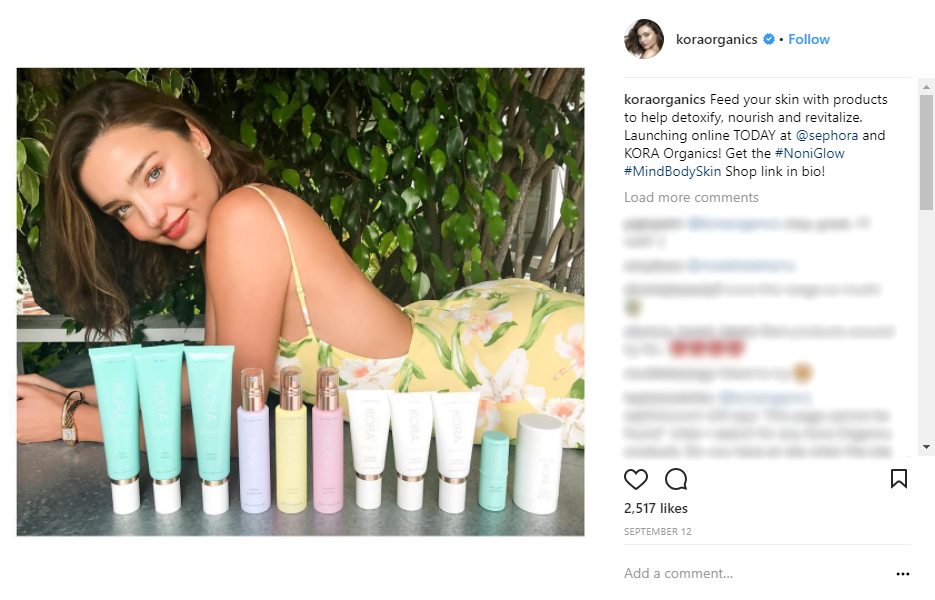

Source: Kora Organics’ official Instagram

Source: Kora Organics’ official Instagram Source: Ionetek

Source: Ionetek Source: Guided Selling.org

Source: Guided Selling.org

Source:

Source:

Source:

Source:

Organic skin care product alley in a Carrefour store in Nice

Organic skin care product alley in a Carrefour store in Nice